37+ How much can i borrow on 80000 salary

As an example if. 37 How much does it cost to borrow 80000.

Onlinelibrary Wiley Com

Lending activities can be directly performed by the bank or indirectly through capital markets.

. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Use the mortgage calculator to provide an illustration of monthly repayment amounts for different terms and interest rates on a 8000000 mortgage. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. An 80000 personal loan might sound like an incredible amount to borrow but there are lenders who frequently offer such loans under specific circumstances. So if you make 80000 a year you should be looking at homes priced between 240000 to 320000.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. You can further limit this range by figuring out a comfortable monthly.

If you are taking a home loan for 40000 salary you can get a maximum home loan amount of Rs. Were not including any expenses in estimating the income you. Apply to Borrow 80000 90000 Loans Today.

So to buy the. Browse the monthly payments below for a 80k loan based on time and interest rate. You can borrow 40000 with.

For now lets just say that with a loan amount like 70000 interest can make a much bigger impact than on a loan amount like. Whats the monthly payment of a 70000 loan. How much house can I afford if I make 80000 a year.

Email the 8000000 Mortgage. If you borrowed 46000 over a 15-year term at 840 pa. Amount the interest rate and the term of the loan can have a dramatic effect.

How much can I borrow on my salary for a mortgage. Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. Invest borrow and spend all in one place.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Your repayments like the amount of interest you pay and how much you can borrow in the first place will depend on a number of factors. 465 65 votes The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly.

So for example if you had an annual salary of 200000. Adjust the inputs on this calculator. Use our loan payment calculator to determine the.

If you want to do the math on your own the quickest way to estimate a reasonable range for your home purchase is to multiply your annual. Your salary will have a big impact on the amount you can borrow for a mortgage.

2

How Can A Bank Go Bankrupt Quora

How Does A Coin Machine Read Money Quora

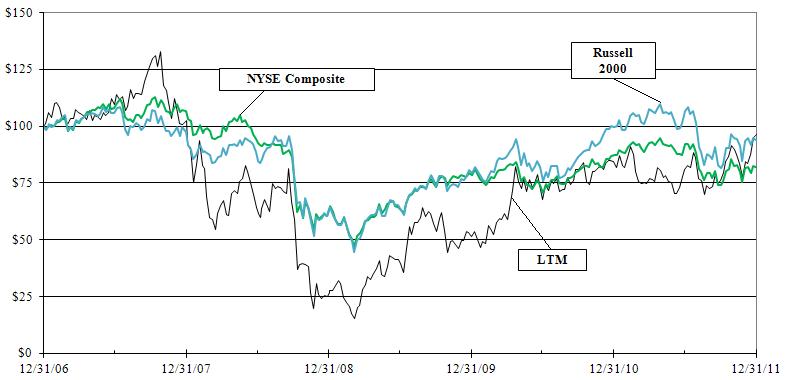

Ltm 2011 10k

2

Bioheart Inc

2

2

2

Bioheart Inc

2

If You Pay For Hentai Does That Promote Abuse And Human Trafficking In The Porn Industry Quora

2

How Does A Coin Machine Read Money Quora

How Can A Bank Go Bankrupt Quora

2

Internet Blackout Protests Leave Gig Workers Reeling Being A Landlord Start Up Cab Driver